main street small business tax credit 1

A qualified small business tax credit employer is the one who files an original tax return to get the Main Street Small Business tax credit instead of an amended one. We know RD tax credits like the back of our hand and weve got the resumes to prove it.

How To Write Off Sales Taxes Turbotax Tax Tips Videos

Tax Credits LLC In Piscataway NJ.

. The Main Street Small Business Tax Credit is a bill that provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that caused massive financial. Incentives depend on the HERS score and the classification. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit.

In order to determine the net. Tax Office 746 State Route 18 Ste 1 East Brunswick NJ. With 25 years of experience across the Big 4 consulting.

Apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally. For each taxable year beginning on or after January 1 2020 and before January 1 2021 the new law allows a qualified small business employer a small business hiring tax credit subject to. NJ Clean Energy- Residential New Construction Program.

Dols-De Matos P A 68 Loretto St New Brunswick NJ. This bill provides financial relief to qualified small businesses for the economic. In August 2022 the Senate the House and then President Biden all approved one of the biggest motions for small businesses and startups in the twenty-first century.

Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. The Main Street Small Business Tax Credit is a relief fund for Californias small businesses to help them get back on their feet and heal the economy. MainStreet works seamlessly with your CPA.

The Tax Office 1 Race Track Rd. Tax Credits LLC at 45 Knightsbridge Rd Piscataway NJ 08854. The Tax Prep 802 Hamilton St Somerset NJ.

This bill provides financial relief to qualified small businesses for the economic. Your Main Street Small Business Tax Credit will be available on April 1 2021. If your business is eligible for the tax credit you will receive 1000 per net employee hired during July 1 2020 through November 30 2020.

Find information on Tax Credits LLC including this business SIC codes NAICS codes and General Liabilility Class codes. Tax Credits LLC is primarily.

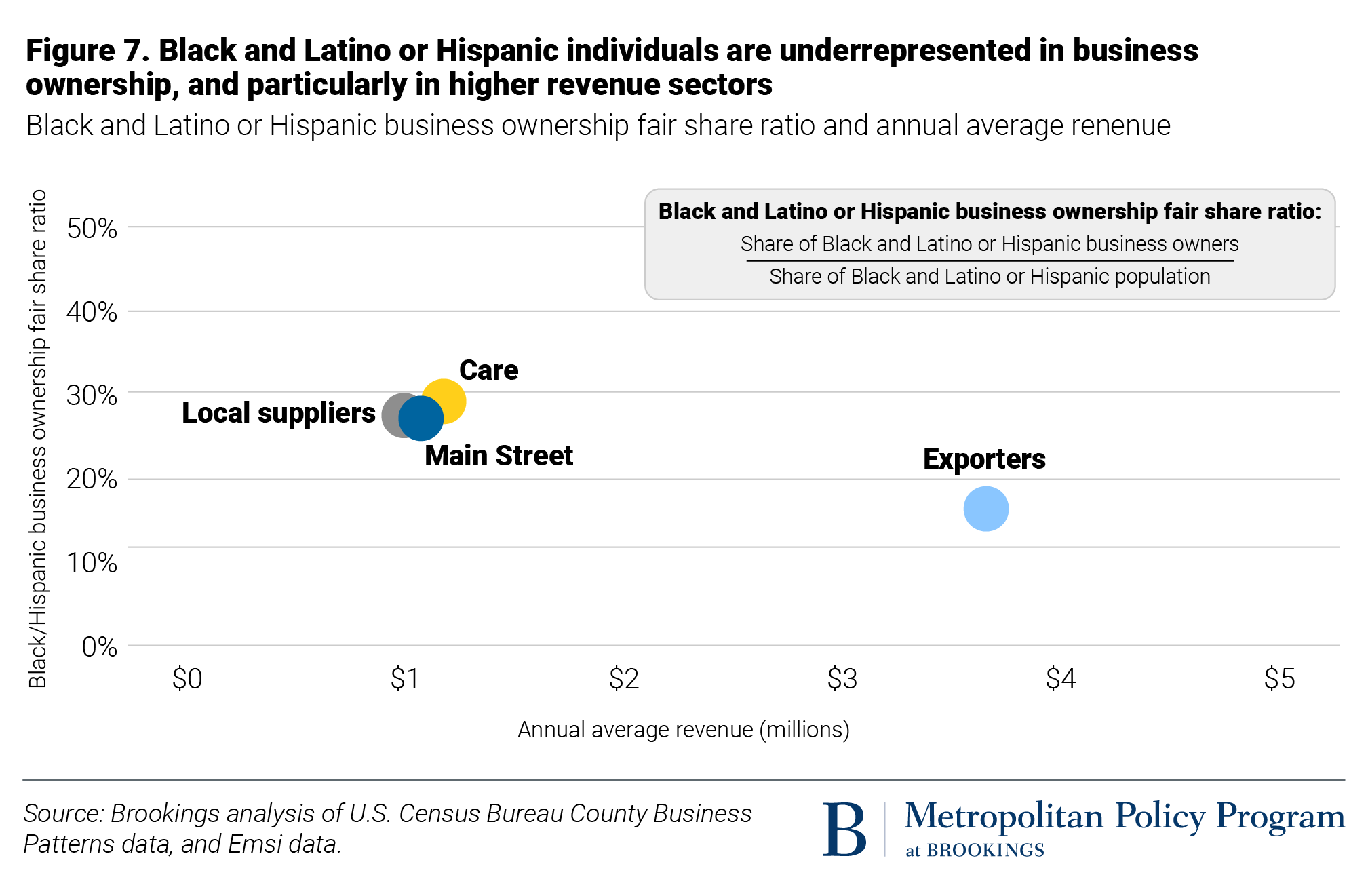

From Relief To Recovery Using Federal Funds To Spur A Small Business Rebound Stage 2 Recovery

10 Ways Small Businesses Benefit Their Local Communities By Bbb Medium

Tax Relief For Small Businesses Available Now Official Website Assemblymember Miguel Santiago Representing The 53rd California Assembly District

2021 Main Street Small Business Tax Credit In California Heather

Hawthorne Auto Clinic And Deborah Field Main Street Alliance Of

Business Tax Credits Your Business May Qualify For Gusto

Perspectives From Main Street The Impact Of Covid 19 On Communities And The Entities Serving Them 2021 Fed Communities

California Main Street Small Business Credit Ii Kbkg

California Main Street Small Business Tax Credit Ii Krost

A Guide To Tax Deductions For Home Based Business

California Main Street Small Business Credit Ii Kbkg

The Main Street Small Business Tax Credit For Small Businesses Launched Last Week Get Started And Learn More At Taxcredit Cdtfa Ca Gov By State Of California Franchise Tax Board Facebook

Main Street Small Business Tax Credit Ii

Main Street Small Business Tax Credit Available For Cal Businesses

First Come First Served By November 30 California Hiring Tax Credit Ii Windes

Small Business Tax Credits The Complete Guide Nerdwallet